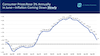

The Consumer Price Index (CPI), the broadest measure of consumer prices, rose 3% annually in June. That is down from 4.1% in May and well down from the peak of 8.8% in June 2022.

Dig Deeper:

- Much of the drop is due to inflation being so high a year ago, known as “base effects”, and the drop in gas prices.

- On a monthly basis, inflation rose 0.2% from May to June, up slightly from the 0.1% rise from April to May

Big Picture: Despite the progress, inflation remains well above the Federal Reserve’s 2% target, and the underlying data is more concerning. Core prices, which strips out volatile elements like food and energy, rose 4.8% on an annual basis and 0.2% from May to June.

Be Smart:

- The Fed looks more closely at core prices than the overall inflation number, which has been stuck around 5% since late 2021.

- The drop in the headline inflation number will prompt many to say the Fed should stop raising rates, but the stickiness of the core data likely means the Fed will continue raising rates at its next meeting later this month.

Strong Labor Market Shows Signs of Slowing

July 12, 2023

June’s jobs report was merely good rather than extraordinary. Job gains were 209,000 while expectations were for 240,000.

- The April and May job gains were revised down by a combined 110,000.

Big picture: The labor force grew by 133,000, and we are now almost 2.5 million workers above the pre-pandemic participation level.

- But: If we had the same participation rate now as in February 2020, there would be 1.9 million more workers in the labor force.

Looking ahead: The jobs market must cool from its scalding-hot pace – a sign Federal Reserve is looking for that higher interest rates are having their intended effect.

Job Openings Were Down in May But Worker Shortage Continues

June 7, 2023

Employers may be pulling back on hiring in anticipation of a slowing economy, but the labor market remains tight. Job openings were 9.8 million at the end of May, 496,000 below their April level.

Why it matters: Employers still face a serious worker shortage. There are 3.7 million more job openings than unemployed workers.

By the numbers:

- Openings increased in educational services (45,000), state and local government education (37,000), and federal government (24,000).

- Openings decreased in health care and social assistance (285,000), finance and insurance (139,000), and other services (78,000).

Dig deeper:

- The Chamber’s America Works Initiative helps employers across the country develop and discover talent to fill open jobs and grow our economy.

Durable Goods Orders Surge

June 30, 2023

New orders for durables goods are on a strong run. They surged 3.3% in March, rose 1.2% in April, and increased 1.7% in May. This trend is an encouraging sign for the economy.

Why it matters: Durable goods are an important economic indicator because they are long-lasting, more expensive items that consumers and businesses purchase.

Be smart: Consumers and businesses buy more of them when they feel better about their long-term prospects and that of the broader economy. They often use credit to buy them due to their large price tags.

- For consumers, they include computers, appliances, and cars.

- For businesses, durables include bigger items like airplanes, heavy machinery, and other capital goods necessary to manufacture products.

By the numbers: All categories of durables saw gains in May. Some of the bigger increases came in cars (2.2%) and airplanes (33%). Capital goods (excluding planes) rose a respectable 0.7% on the month.

Bottom line: The last three months of impressive sales of durables tells us businesses and consumers have confidence the economy will be strong going forward.

Offices are Still Less than 50% Filled

June 28, 2023

Workers’ reluctance to come back to the office is causing a major disruption in the office space market. Offices in ten large cities were occupied at less than 50% of their pre-Covid occupancy rate, according to the security company Kastle.

Why it matters: The drop in occupancy, coupled with higher interest rates, is causing the value of office buildings, particularly in downtown urban areas to drop.

Big picture: This will create problems for lenders that are heavy financers of office buildings. They may face losses as building owners walk away from underperforming buildings.

- However, those lenders are well-capitalized to absorb the losses. And the potential pain should be concentrated. Office space makes up only 15% of the entire $21 trillion commercial real estate market, according to Nareit estimates.

Looking ahead: The downturn in the office space market should be short-lived. When workers come back into the office more and interest rates fall – perhaps late next year – demand for office space will rebound.

ICYMI: The Chamber’s Future of the Office survey finds that government red tape is a major barrier to converting empty office space.

The Future of the Office Hindered by Regulations

June 23, 2023

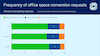

Permitting and environmental regulations will limit efforts to convert offices into residential or new commercial space, according to the Chamber’s Future of the Office survey.

Why it matters: These barriers hold businesses back from modernizing valuable office real estate.

- Work-from-home is here to stay following the pandemic and is causing businesses to reevaluate how much space they use and how they use it.

According to the survey, 46% say zoning and/or permitting issues impact office building conversions, and 44% say the same about environmental regulations.

- These concerns rank almost as high as the impact of building layouts (47%) and floor plan configurations (42%) on office conversions.

The appetite is strong. Seven in ten builders (71%) and two in three architects (68%) are receiving more frequent requests to convert existing office space to different uses.

- While conversion to housing is one possible use for empty offices, more than half of architects surveyed (54%) say that converting office spaces into other commercial uses will be a trend in the coming year.

Our take: Cities who want to adapt and thrive will look to reform their zoning, permitting, and environmental reviews to make it easier to convert what would otherwise be vacant office space to retail, hospitality, entertainment space, or housing.

Read more from the Chamber:

- Economic Data: Comprehensive quantitative snapshots of business sectors and topics to help business and political leaders make informed decisions.

- Workforce Data:Capturing the current state of the U.S. workforce.

- Small Business Index: The MetLife & U.S. Chamber of Commerce Small Business Index is released on a quarterly basis and is compiled from 750 unique online interviews with small business owners and operators each quarter. The Index delivers a comprehensive quantitative snapshot of the small business sector as well as explores small business owners’ perspectives on the latest economic and business trends.

- Middle Market Business Index:The survey panel consists of approximately 1,500 middle market executives and is designed to accurately reflect conditions in the middle market.

About the authors

Curtis Dubay

Curtis Dubay is Chief Economist, Economic Policy Division at the U.S. Chamber of Commerce. He heads the Chamber’s research on the U.S. and global economies.